how much federal tax is deducted from a paycheck in ma

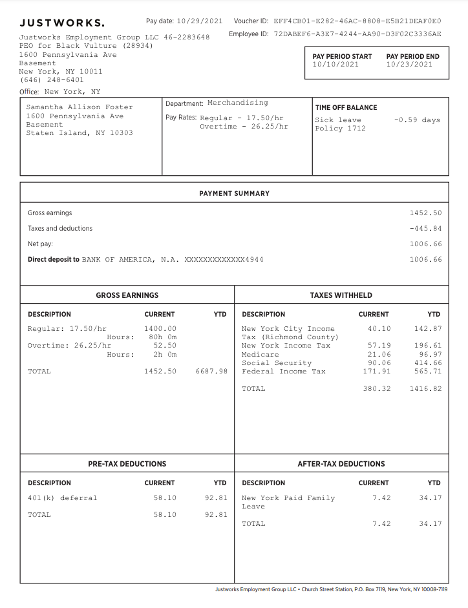

Deduct federal income taxes which can range from 0 to 37. It simply refers to the Medicare and Social Security taxes employees and employers have to pay.

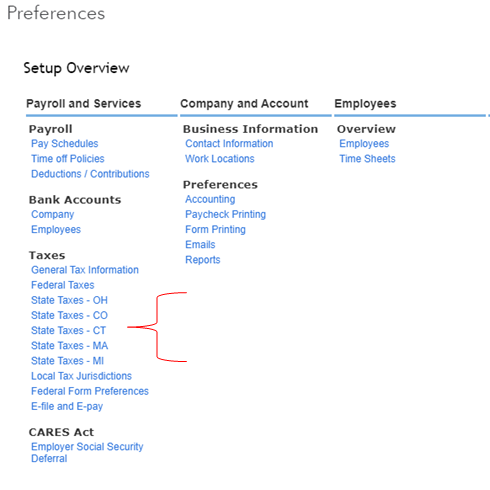

2022 Federal State Payroll Tax Rates For Employers

In Ohio workers making less.

. No local income tax. Subject to Paid Family and Medical Leave PFML payroll tax. If your tax is less than 500 a year you can pay the tax when you complete your annual summary.

The income tax is a flat rate of 5. This marginal tax rate. From your paycheck the total tax constituting FICA is 29 Medicare and 124 Social security of your wages.

Unlike with the federal income tax there are no tax brackets in. The social security tax is 62 percent of your total pay until you reach an annual income threshold. That rate applies equally to all taxable income.

Estimate your federal income tax withholding. Winners in other locations could pay as much as 1075 in state or local taxes according to USA Mega. 22 for 40525 - 86375.

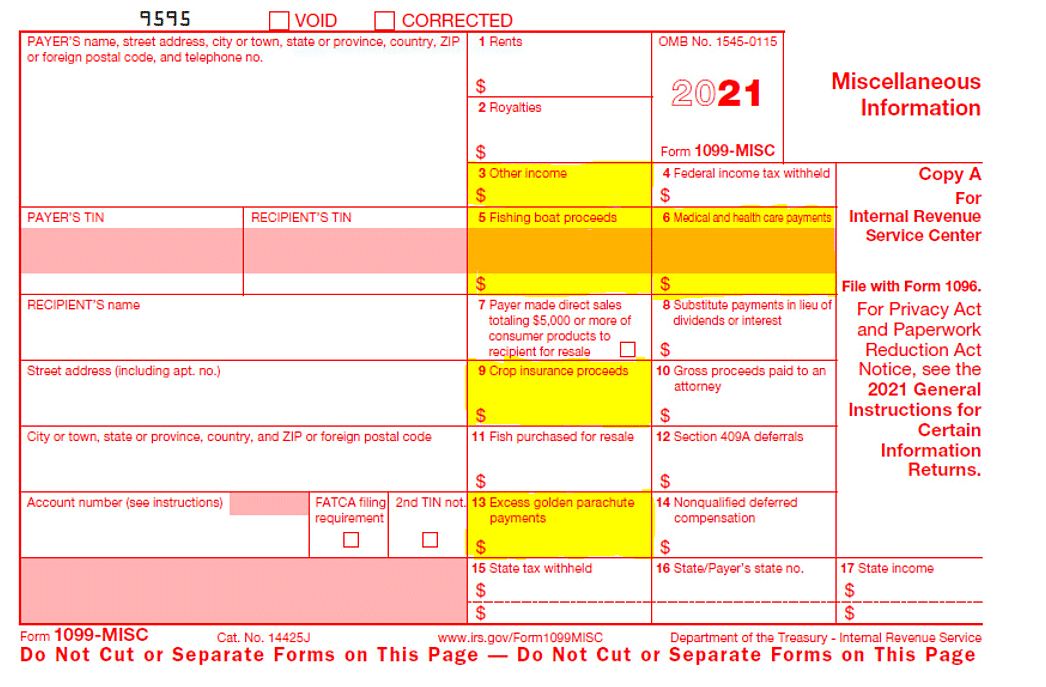

Taxpayers who have paid Massachusetts personal income taxes in a prior year on income attributed to them under a claim of right may deduct. See how your refund take-home pay or tax due are affected by withholding amount. On September 30 2021 the Massachusetts Legislature adopted an elective pass-through entity excise tax in response to the federal state.

The state charges income tax in five brackets ranging from 0 to 399. Contacting the Department of. Paycheck Deductions Payroll Taxes.

Use this tool to. The amount of income tax your employer withholds from your. Ohios income tax is low compared to the federal tax rate.

Learn about the Claim of Right deduction. Ohio income tax rate. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

Able to claim state-level exemptions. Your average tax rate is 1198 and your marginal tax rate is 22. For federal unemployment tax quarterly payments are required if your tax is greater than 500.

The amount of federal and Massachusetts income tax withheld for the prior year. The income tax rate in Massachusetts is 500. That annual salary is divided by the number of pay periods in the year to get.

The total Social Security and Medicare taxes withheld. The income tax rate in Massachusetts is 500. 1 day agoThe winneror winnerswill owe 24 to the IRS in federal taxes.

For employees withholding is the amount of federal income tax withheld from your paycheck. Taxpayers who have paid Massachusetts personal income taxes in a prior year on income attributed to them under a claim of right may deduct such amounts of that income. How It Works.

Massachusetts Income Tax Calculator Smartasset

Getting Error Message When Inputting Employees Info Stating Medicare And Ss Are May Be Incorrect

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

A Complete Guide To Massachusetts Payroll Taxes

Free Online Paycheck Calculator Calculate Take Home Pay 2022

New Tax Law Take Home Pay Calculator For 75 000 Salary

Massachusetts Paycheck Calculator Smartasset

Salary Paycheck Calculator Calculate Net Income Adp

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Payroll Software Solution For Massachusetts Small Business

Learn More About The Massachusetts State Tax Rate H R Block

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Withholding Calculator Paycheck Salary Self Employed Inchwest

How Much Does Government Take From My Paycheck Federal Paycheck Deductions

Questions About My Paycheck Justworks Help Center

Here S How Much Money You Take Home From A 75 000 Salary

Payroll Information For Massachusetts State Employees Office Of The Comptroller

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov